Source - Where Does John C. Bogle Keep His Money?

Jack Bogle’s Portfolio Asset Allocation

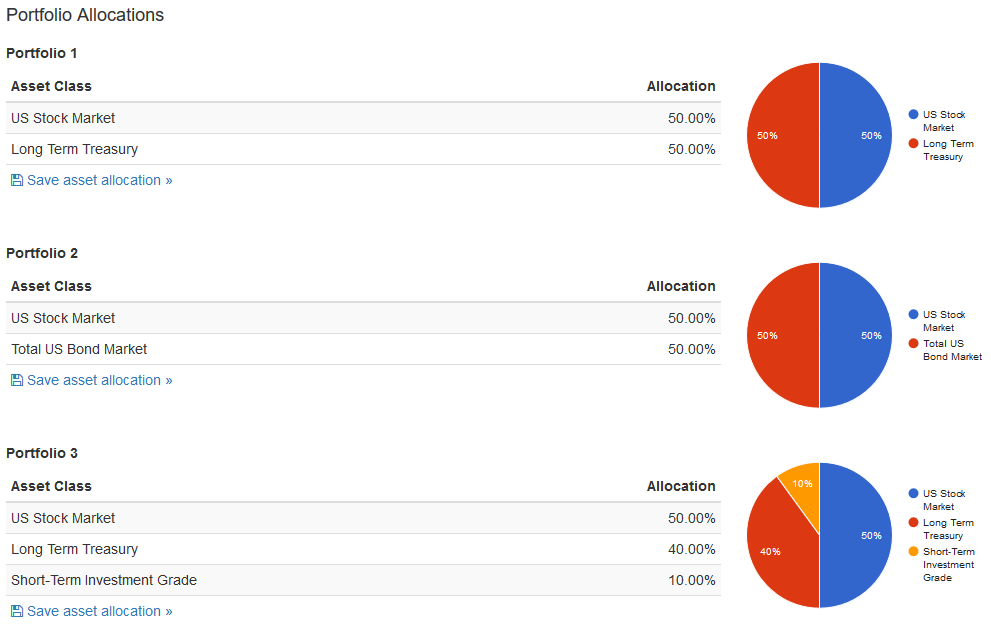

In 2015, Bogle revealed his retirement portfolio allocation had shifted more toward a 50/50 allocation, with 50% in equities and 50% in bonds, away from the standard allocation of 60/40 that he followed for years. As he told the interviewer, “I just like the idea of having an anchor to the windward.” Bogle has indicated his non-retirement portfolio had an asset allocation of 80% bonds and 20% stocks.

Beyond that, Bogle said he does not believe you need any other types of investments or asset classes to achieve proper diversification. Outside of his personal and retirement portfolios, Bogle also reported invested in the Vanguard Balanced Index (VBINX) for his grandchildren.

Product summary

This index fund offers investors an easy, low-cost way to gain exposure to stocks and bonds. The fund invests roughly 60% in stocks and 40% in bonds by tracking two indexes that represent broad barometers for the U.S. equity and U.S. taxable bond markets. The fund’s broad diversification is important, because one or two holdings should not have a sizeable impact on the fund. Investors with a long-term time horizon who want growth and some income—and who are willing to accept stock and bond market volatility—may wish to consider this as a core holding in their portfolio.

What Stock Allocation Might Have Looked Like

Bogle does seem to follow his own advice as far as investing in index funds. He once told BusinessWeek that he is an indexer, commenting: "I own the market. And I’m happy.”

Of course, this is based on his core principle that people trying to beat the market find themselves on the losing side at least as often as the winning side, but they pay a higher price. Bogle has also said he prefers to index the entire stock market rather than just the S&P 500. At the time, he allocated 60% of the stock portion of his portfolio to the Vanguard Total Stock Market Index (VTSMX) along with some combination of the Vanguard 500 Index (VFINX) and the Vanguard Extended Market Index (VEXAX) to provide additional small- and mid-cap exposure.

ボーグル氏が買っている商品

- 株式 - Vanguard Total Stock Market Index (VTSMX)とVanguard 500 Index (VFINX)とVanguard Extended Market Index (VEXAX)

- 債券 - Vanguard Intermediate-Term Bond Index (VBILX) and Vanguard Inflation-Protected Securities (VIPSX), Vanguard Limited-Term Tax-Exempt Fund (VMLTX)

株は米国株一択...海外株には投資していないようです。

Bogle has said on numerous occasions that he never invests in any overseas funds. He has a very small portion of his equity assets in a few sentimental holdings that happen to be active funds. These include the Vanguard Wellington (VWELX) and Vanguard Wellesley (VWINX) Income Funds.

ジョンボーグル(John Bogle)著書