メモ:クレジットスコアの計算式は以下で、ウェブサイトでチェックできる...ANA CARD USAもFICOスコアが見れるようです。

FIOSのスコア詳細は以下:

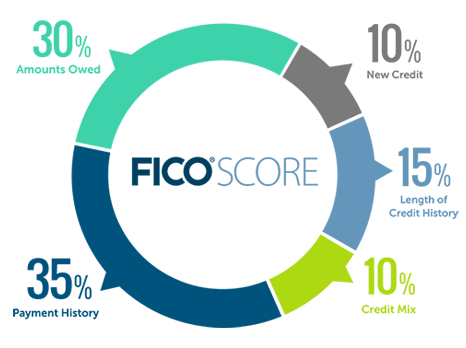

How are my FICO® Scores calculated?

FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

Payment history (35%)

The first thing any lender wants to know is whether you've paid past credit accounts on time. This helps a lender figure out the amount of risk it will take on when extending credit. This is one of the most important factors in a FICO® Score.

Be sure to keep your accounts in good standing to build a healthy history.

Amounts owed (30%)

Having credit accounts and owing money on them does not necessarily mean you are a high-risk borrower with a low FICO® Score. However, if you are using a lot of your available credit, this may indicate that you are overextended-and banks can interpret this to mean that you are at a higher risk of defaulting.

Length of credit history (15%)

In general, a longer credit history will increase your FICO® Scores. However, even people who haven't been using credit long may have high FICO Scores, depending on how the rest of their credit report looks.

Your FICO® Scores take into account:

-

how long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

-

how long specific credit accounts have been established

-

how long it has been since you used certain accounts

Credit mix (10%)

FICO® Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. Don't worry, it's not necessary to have one of each.

New credit (10%)

Research shows that opening several credit accounts in a short period of time represents a greater risk-especially for people who don't have a long credit history. If you can avoid it, try not to open too many accounts too rapidly.